by: Michelle Ogden, CFP®, CRPS®, CKA®

Financial literacy is about so much more than money

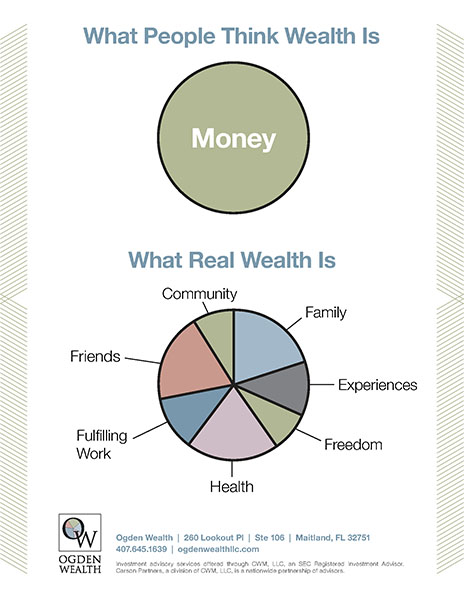

When people talk about financial literacy, they tend to think in terms of money—of income, expenses, budgets, investments, and return on those investments.

There’s so much more to financial literacy than that.

True financial literacy is not just a strong ROI, it’s a positive ROL—return on life.

If you tell me you want a $20 million net worth at the age of 80 and I help you hit that financial goal but you have not enjoyed your life, I have failed you.

While financial literacy is a critical element in wealth management, all of our client relationships are built on the return on life concept. It’s about living life to the fullest and investing in today as well as for the future.

As your wealth advisor, am I going to tell you to do things like live below your means, save and invest when you’re young, calculate the cost of every investment with the potential return, and maintain a balanced portfolio in line with your risk tolerance and goals?

Yes.

I’m also going to tell you to apply the standard financial literacy advice to every part of your life, not just the bucket of your bank accounts and investments. Apply it to your health, your marriage, your other relationships, your career—everything.

In its simplest form, the process looks like this:

- Take an honest look at where you are right now.

- Define your ultimate goal.

- Develop a realistic plan for reaching your goal.

- Schedule regular progress evaluations and make adjustments to your plan as necessary.

So if one of the ways you can improve your life is by improving your health, and you can do that by losing weight, you would:

- Weigh yourself.

- Decide what your target weight is and set a realistic date for reaching it.

- Put together a plan for reaching your goal—changing what you eat and how you shop for food, exercising more, and so on.

- Check your weight and periodically adjust your plan as needed.

Maybe the spark has gone out of your marriage. You could:

- Sit down with your spouse and have a candid conversation about where you are now.

- Agree on where you want to be.

- Decide on what you have to do to get there, create a plan (maybe it includes more date nights, improved communications, exploring new hobbies, or even couples therapy), and make a mutual commitment to doing it.

- Periodically evaluate your progress and make changes if you need to.

The same process you use to calculate the return on your financial investments works to calculate the return on every part of your life.

The bottom line is this: When you don’t have a strong return on life, your return on investment doesn’t really matter.