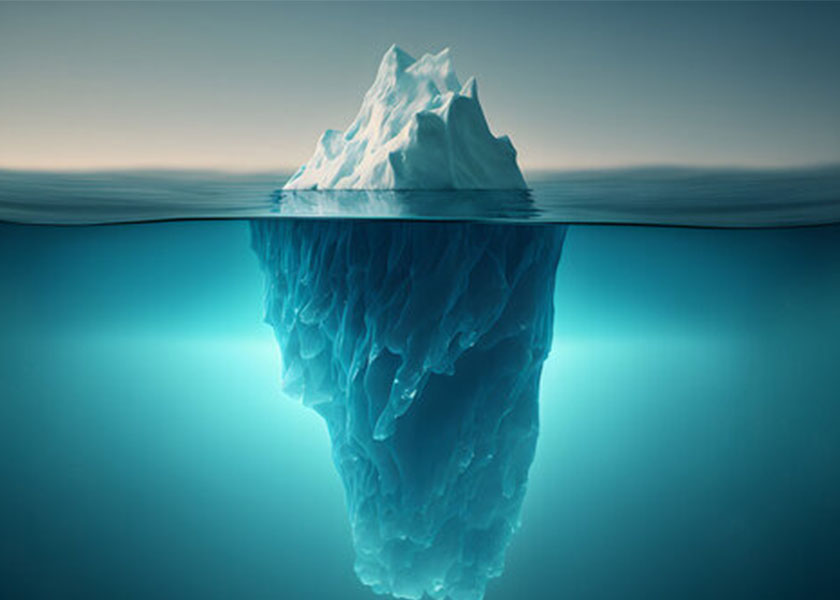

You have your retirement numbers nailed down. You know how much you’re planning to spend, how much income you’ll need, and how you’re going to generate that income. But the financial component is just the tip of the iceberg. It’s the part we can calculate and see. What’s beneath the surface is the real and often unspoken part of the transition we call retirement.

It’s natural for our personal identities to get wrapped up in what we do for a living—after all, we spend most of our waking hours working. But what happens when we’re no longer running our companies and practicing our professions?

Business owners, executives and professionals face a range of emotional and spiritual challenges during this season of transition. Sadly, it often doesn’t go well. One friend said, “In addition to a financial plan you need a purpose plan.” Proof of that is in a Price Waterhouse study that revealed that 7 out of 10 business owners were profoundly unhappy with their exit outcome one year later.

Retirement combines a major life transformation with an equally critical business transition. Your excitement and optimism can easily be overshadowed by deep anxiety, fear, grief, stress, and even anger and shame. If that happens, the result can be a devastating emotional decline.

My mission is to help our clients be among the minority who enjoy a retirement journey that is positive and satisfying. We do that by talking about the process long before it happens, so you’re not blindsided by depression, doubt and despair. We encourage our clients to retire to something, not just from something. Here are some specific steps we advise:

- Plan ahead. Whether you own the company or work in a key executive position, your exit should be planned years in advance, if possible. Help your heart let go well before it’s time for the physical departure.

- Be motivated by all the right reasons. Make a positive move toward a new season without desperation or anxiety. Answer God’s call to a new vocation, an exciting volunteer position, or even to simply spending more time with your family.

- Build a trusted friend group in advance. The majority of our community comes from the work we do, and once you retire, you won’t have those friends. The common bond that was the glue of the relationship was the work. Once you remove that, the friendship will naturally dissipate. Develop friends outside of work and “calendar the connection” so you have these established friendships for this next phase of life.

- Anticipate and welcome the couples conundrum. For my married friends, this is when, all of a sudden, you have too much time with your significant other. And they may or may not have friends outside of work. Be patient in helping them find new friends, hobbies and ways to invest their new abundance of time.

- Acknowledge your feelings. There’s a saying “you have to feel it to heal it.” Don’t stuff your emotions but instead recognize your feelings and address them. Read books, listen to podcasts and talk to trusted family and friends where you can openly and honestly share your feelings. No matter how well-prepared you are, those negative emotions are going to creep in. When they do, talk about them with people you trust.

- Have a post-exit plan. Leaving your business isn’t your final destination, it’s just another mile marker on your journey. Your life is going to change. You’ll rediscover who you are beyond your job title. Commit to a time of rest and renewal as you discern your next steps and move ahead with deeper maturity and wisdom.

- Surrender. Take the necessary practical steps to define and accomplish your goals, and then let go of the outcome. Offer it all up in prayer and let God handle the next best step. I often say, “We plan, and God laughs.” Visualize the perfect scenario of future and then “let go and let God.”

If you do all this, will the process be perfect? Probably not. But you’ll be prepared to walk a path that, while not always smooth, will be rich with adventure and new opportunities.